In 2006, mathematician Clive Humby said: “Data is the new oil” and as the years have passed, the quote has become much more relevant. The more the data you have, the better a product you can create and the more targeted your strategy can be. While e-commerce companies have been utilizing data since long for delivering superior customer experience, BFSI (Banking, Financial Services, and Insurance) sector started doing it very late. A digital revolution came in when data became cheap in 2016 and consumers started moving online much faster and this is when Acko came into picture.

Before getting into the details about Acko, let's understand how an insurance business works.

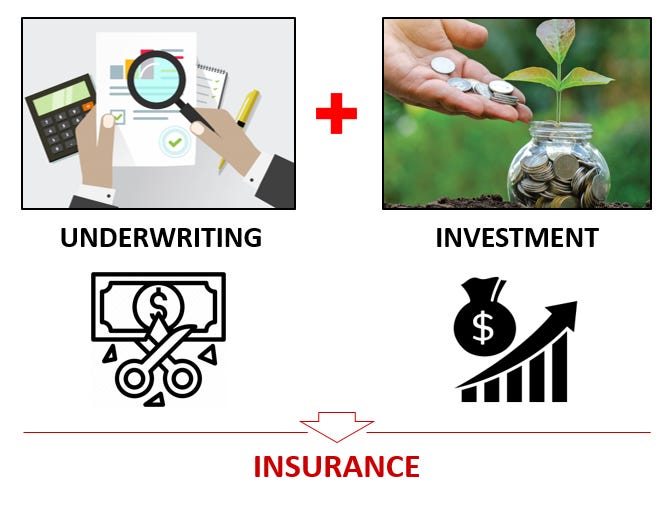

Every insurance company has two segments- Underwriting and Investment. The underwriting segment takes care of selling policies and processing the claims and the investment segment uses the wealth accumulated from policies, to make money by investing in various financial instruments (debt, equity etc.)

The more insurance you sell, the more premium you get and hence the more you could invest. However, as with everything in life, greed never makes you better off. Aggressive strategy leads to insurers attracting high risk users, many among whom ultimately end up filing claims.

Contrary to popular belief, most insurers lose money in the insurance part of the business because claims almost always end up being higher than the premiums collected. In fact, only 6 out of 34 companies selling general insurance in India, made money from underwriting. It is the investment side of the business that makes money, more than offsets the losses in the insurance segment and hence helps companies produce profits.

Now that you know how an insurance business operates, think about what if an insurance company has access to a user’s data and could identify and reject the high risk users? This could lead to significantly reduced claims and that's where Varun Dua saw an opportunity.

The Data Business

With the premise that combining insurance and technology could help identify high risk customers while at the same time, provide a superior experience to the user, Acko was started in September 2016 as a pure-play digital insurance company. Before it even had a license, the company was able to raise $30M from investors by selling the promise of disrupting the insurance market which had till now been majorly dependent on distributors (brokers/ agents).

Majority of sales for a traditional insurance company comes from distributors (agents or brokers). Since the company does not have direct access to users or to their data, the quality of underwriting is low and hence the risk is higher. In order to cover the risk, insurers end up pricing the policies high (which leads to losing users to competitors with better priced offerings) or end up with losses in the insurance segment in case of low prices. Further, in absence of information about consumer needs, insurers end up offering same or similar products which makes it necessary to employ distributors to reach out to customers and pitch their products.

Acko’s advantage over competitors lies in its approach to consumers. The company uses a direct-to-consumer approach for distributing insurance, allowing for favourable risk selection and superior underwriting. Moreover, by avoiding the 20-30% commission that needs to be paid to the distributors, Acko is able to price its policies lower than most competitors. That’s, in addition, to cost savings by operating without a physical presence.

Since data is the name of the game, Acko has been active in finding ways to get more data about the users. It recently collaborated with multiple consumer internet startups like Bounce and NestAway to establish a rating system that will use data on the offline behaviour of users to assess them on their risk

All the data together, not just guides in developing customized solutions, thus eliminating the need to hard-sell and invest a lot on a distribution network, but also helps innovate.

Innovation at the Core

While life, health and motor insurance have been the focus of all traditional insurance companies, Acko also focuses on creating and selling microinsurance products.

Ashwin Ramaswamy, head of partnerships, Acko, sees four components in microinsurance: micro price (low premium); micro duration (a single bus ride or over a few months); micro cover (few thousand rupees to a few lakh) and micro claim, settled digitally and quickly.

The products are micro, but their target market is massive. For example, about 15 million cycles are sold in a year in India, which translates into an insurance premium potential of about Rs 100 crore. Spectacles represent a Rs 2,800 crore premium opportunity and the mobile phone insurance market is worth around Rs 12,000 crore a year. The target audience is those below 35 years of age who “are tech-savvy and can afford such products”.

In order to ensure that it makes a name for itself in the microinsurance space, following the steps of the Chinese insurance giant Zhong An, Acko has created multiple partnerships in its pursuit of internet economy deals, primarily consisting of e-commerce, ride-hailing and travel site-focused products.

The partnerships serve two objectives. First, utilizing the data received from the partners helps Acko in creating products useful for the customer and sustainable for the company, as noted in the excerpt from Economic Times:

A year ago, Acko launched ‘Ola trip insurance’ — a one-rupee cover for Ola cab users against missed flights, accidents and baggage losses — designed solely by reading data.

Acko built a lot of ‘possibilities’ using data modelling tools. Most of the time, Ola customers missed flights due to unexpected traffic blocks or client delays (Ola customer delays); baggage losses and accidents were rare. These summations were the outcome of processing several micro-data bits such as Ola accidents-per-day, driver delays, customer delays, missed flight records, and baggage loss complaints.

As per Animesh Das, product strategy head at Acko, the product is sustainable at the premium of 1.

Second, and more important, the low-value products help create a database of customers who can later be sold more expensive and higher-margin products such as motor insurance.

However, cross selling would be possible only when the consumer is delighted by the current service and is excited about trying the new service being sold and that is what Acko is working on.

Integration

An article published in Harvard Business Review highlights the different elements of value that a business must provide its consumers in order to delight them.

Acko already meets most of the functional needs highlighted in the framework and is now moving towards checking all functional boxes and delivering some emotional needs.

In June 2019, Acko acquired VLer, a company working on solving the broken car retail experience in the country by bringing in a fluid, transparent, and haggle-free experience of purchasing a car – primarily digitally.

This was followed by a strategic investment in car servicing platform Pitstop to boost Acko’s auto claim servicing capability and its promise of three-day doorstep pickup, repair and delivery services.

A customer-centric product design, instance-based products, customized real-time pricing and instant claim verification and settlement that Acko provides, has not just attracted a slew of investors including the likes of Amazon, Binny Bansal and Munich Re Ventures but also consumers, leading to ~$55M gross written premiums in FY19-20, a huge feat for a company been in the market for just 2.5 years.

The company is in losses currently but if Acko is able to really drive the business by data and technology, it won’t take long for it to be able to give a fight to the Indian insurance giants.

Recommended read: HBR article on the Elements of value for B2C businesses

In case you liked the article, do share with those who might be interested in it and do consider subscribing :)

That was good quick revision from the basics of insurance to this day digital disruption in the industry!

The Ola example is fantastic!

What information acko could have acquired by partnering with Nestaway and Bounce?