(#16) International UPI: Potential Visa/ Mastercard killer

Explainer of how NPCI is moving forward strategically to end the duopoly of Visa and Mastercard in India through the trio of UPI, International UPI and Rupay credit cards

For a long time, the largest substitute for Visa and Mastercard in India was cash. While both networks dreamt of taking away the share of cash in the market, it was UPI which actually lived that dream.

Infact, UPI has not just taken away share from cash but also from other digital instruments like cards and wallet. At the same time, it has single handedly expanded the digital payments market.

While UPI attacked Visa and Mastercard’s territory indirectly, another weapon from NPCI’s arsenal — Rupay —is attacking it directly. The 12 year old card network has gone from being a non-significant player to being the largest card issuer in the country.

Through multiple policy interventions, RBI, NPCI and government have added large amount of artillery to Rupay’s kitty and the most recent one is international UPI, a product which has potential to affect Visa/ Mastercard much more than UPI did because it will directly attack one of the healthiest and fastest growing revenue streams for networks: International assessments.

Infact, it won’t be an exaggeration to say that if NPCI does not allow the two card networks on UPI, within some years they would start seeing degrowth in their India business.

Lets dive deeper!

The Swadeshi alternative

UPI’s growth in India’s digital payments space and growth of India’s digital payments space due to UPI, are both well celebrated stories. But what got dwarfed in the explosive growth of UPI was Rupay, India’s own card network.

Rupay was started by NPCI in 2012 as an Indian alternative to global card networks operating in India — Visa, Mastercard, American Express, Diners international. It remained a small network till 2014 but the launch of Pradhan Mantri Jan Dhan Yojana (PMJDY) changed its fortunes.

Under PMJDY, bank accounts were opened for everyone and users were offered Rupay debit cards along with the accounts. With the success of PMJDY, the issuance of Rupay cards went through the roof. At the same time, the government was openly promoting it. As a result, Rupay became the largest card issuing network in India.

Despite being the leader in debit cards, Rupay wasn’t a big pain point for Visa and Mastercard because debit is a small and shrinking segment:

The MDR on debit cards in India is capped at 0.9% and hence there is very little money to be made there

The share of debit card has gone from 20% in FY22 to merely 8% in FY24. Even in absolute terms, while the digital payments space has grown more than 2x since FY22, debit card payments volume has become ~60% of FY22.

But the launch of Rupay credit cards changed things.

A New Animal

In 2017, Rupay launched credit cards. While initially the growth was slow, there were multiple policy interventions made by the government that led to an increase in Rupay transaction volumes:

Nov 2020: Finance minister asked banks to ‘only promote Rupay’

Jun 2022: NPCI allowed Rupay credit cards to be used on UPI

Mar 2024: RBI asked banks to provide option to the customer to choose card network

As a result, today Rupay accounts for ~10% of the total 102 Mn credit cards and ~6% spends by value.

The numbers are exceptional especially considering that just 1 year back, Rupay credit cards accounted for ~3% share by value. More exceptional is the fact that NPCI is targeting to increase Rupay credit card market share to 10% within this year. The biggest contributor to the entire growth story is the fact that Rupay is the only network accepted on UPI— transaction on UPI account for ~50% of the total spends happening on Rupay.

While Rupay continues to grow, another NPCI product— International UPI —has started showing greenshoots and I strongly believe that international UPI will impact Visa and Mastercard much more than UPI and Rupay.

The golden goose

Visa and Mastercard make money by charging a fees for every transaction processed by them. If we look at Visa’s revenue, the biggest and the fastest growing contributor to its revenue is international assessments wherein it charges an international assessment fees over and above the regular fees charged on all transactions.

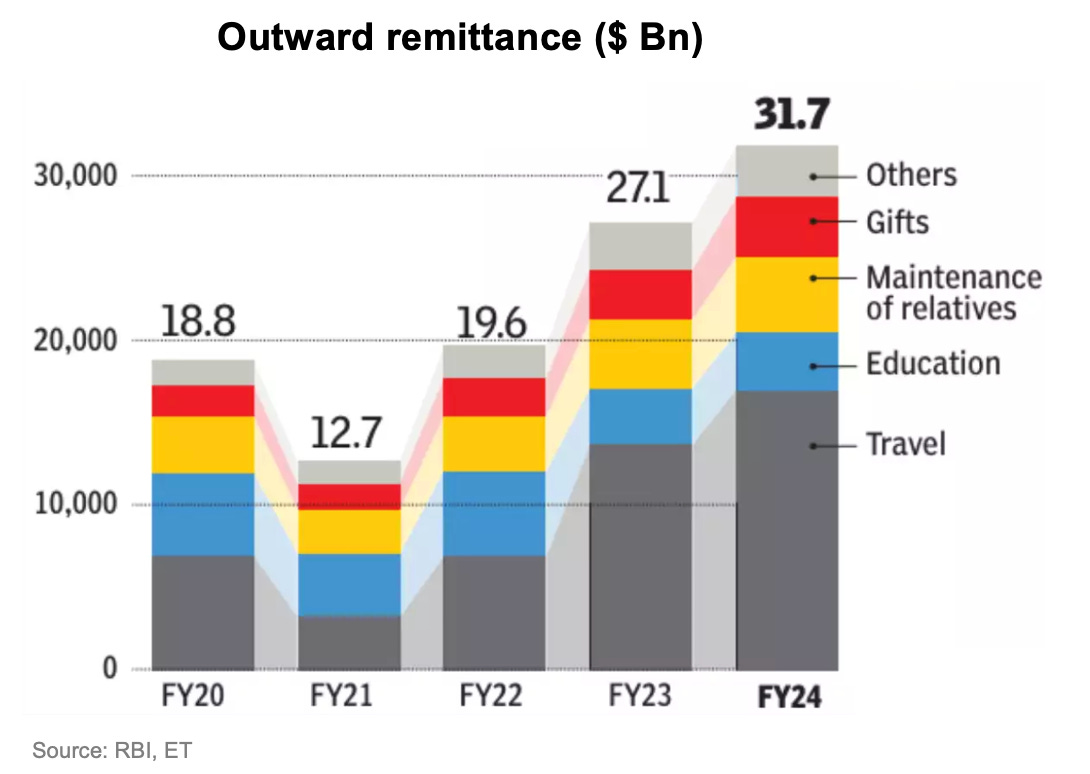

Visa earns this fees whenever the card is swiped in an international location or on an international merchant. Whether we look at remittance data (which among other things includes spends using debit and forex cards) or at credit card payments data, one thing is clear that travel is the largest contributor to international transactions. And it is this very segment that international UPI is attacking.

International UPI has been focused on geographies that are popular among Indian tourists. NPCI started with the lowest hanging fruit — Bhutan — and has went on to add 7 countries in the last 3 years. This includes UAE and Singapore which together account for ~31% of the total international travel done by Indians.

At the same time, NPCI’s plans are grand. From RBI’s annual report:

In light of goals for Viksit Bharat 2047, the Reserve Bank, along with NPCI International Payments Ltd. (NIPL) will work towards taking UPI to 20 countries with initiation timeline of 2024-25 and completion timeline of 2028-29. Further, Fast Payment System (FPS) collaboration with group of countries like European Union and South Asian Association for Regional Cooperation (SAARC), as well as multilateral linkages will be explored

As the acceptance and awareness of international UPI increases, it would see growth similar to what UPI did in India. Add to it the fact that unlike UPI, wherein neither the bank nor the third party providers (like PhonePe) make any money, there is enough money to be made in an international transaction because these transactions would earn the ecosystem ~1.5-2% MDR from the merchant and ~3% foreign currency fee from the users effectively leading to ~4.5-5% returns to the ecosystem. Hence, all ecosystem players have an incentive to promote international UPI. Initial action is already visible with PhonePe starting a subsidiary for international operations, appointing a chief executive for it and doing extensive PR on making UPI live in UAE.

Since Rupay is the only card accepted on UPI, it would be the biggest beneficiary of growth of international UPI and would eventually eat share from Visa and Mastercard.

With NPCI product taking share from all segments, Visa and Mastercard will start seeing degrowth in their India business in some years.

There are just 2 things that can save Visa/ Mastercard:

NPCI allowing the two networks on UPI, which seems unlikely

NFC payments picking pace in the country, which again is something that seems unlikely considering that user behavior of ‘scan and pay’ is already established. Cred did try NFC based payments at a point but even they shifted to UPI eventually because changing consumer behavior is super difficult. It is possible that this might change if Apple Pay goes live in the country, but even that seems far fetched right now