The triple whammy for SBI cards (#13)

Reasons for why SBI Cards is losing market share and the stock is under perfoming the expectations

When SBI cards IPO was announced for subscription, it was the talk of the town and for all the good reasons— credit card penetration was abysmally low in India and hence there was a large market opportunity. At the same time, everyone had confidence in SBI Cards’ execution after all they had proved it in the past— in the five financial years prior to listing, their income had increased 4x and profit after tax (PAT) ~4.5x.

The grey market premium (GMP) for the share hovered around Rs 300-350 per share and analysts had predicted that SBI cards would list at a 40-50% premium.

Hence, I was a really happy when I got the allotment for the stock. But the happiness went away faster than it came.

As the listing drew closer, the market caught the coronavirus fever, and the grey market premiums slowly slipped down to Rs 30-35. Eventually, SBI cards listed at a 13% discount to the issue price of 755.

Today, while credit card market has grown leaps and bounds, the stock continues to trade below its IPO issue price.

But how did such a promising company turn out to be a dud in the share market? It is a story of a wrong choices and changed consumer behavior.

Lets dive deeper.

The credit card frenzy

Traditionally, Indians viewed credit cards as something meant for the rich. As Kotak Mahindra bank pointed in its note in 2022,

Most of India's first credit card users were expatriates familiar with how credit card systems worked. This resulted in a misconception that credit cards are a luxurious foreign consumer product reserved for the extremely wealthy

But times have changed since then. Due to increased financial literacy, awareness created by influencers and attractive rewards, Indians have started adopting credit cards with open arms. From 19 Mn cards in Mar’14, today we are at 101 Mn cards. That is more than 5x growth in 10 years.

Banks have a strong reason to push this growth— credit cards are among the most lucrative instruments and banks make money from multiple streams. They charge a joining and annual fee for the credit card. They earn interchange income when you transact. They earn fees whenever you do late payments/ do foreign transactions/ take cash advances etc. Most importantly, they charge you interest every time you pay late or if you pay only the minimum due.

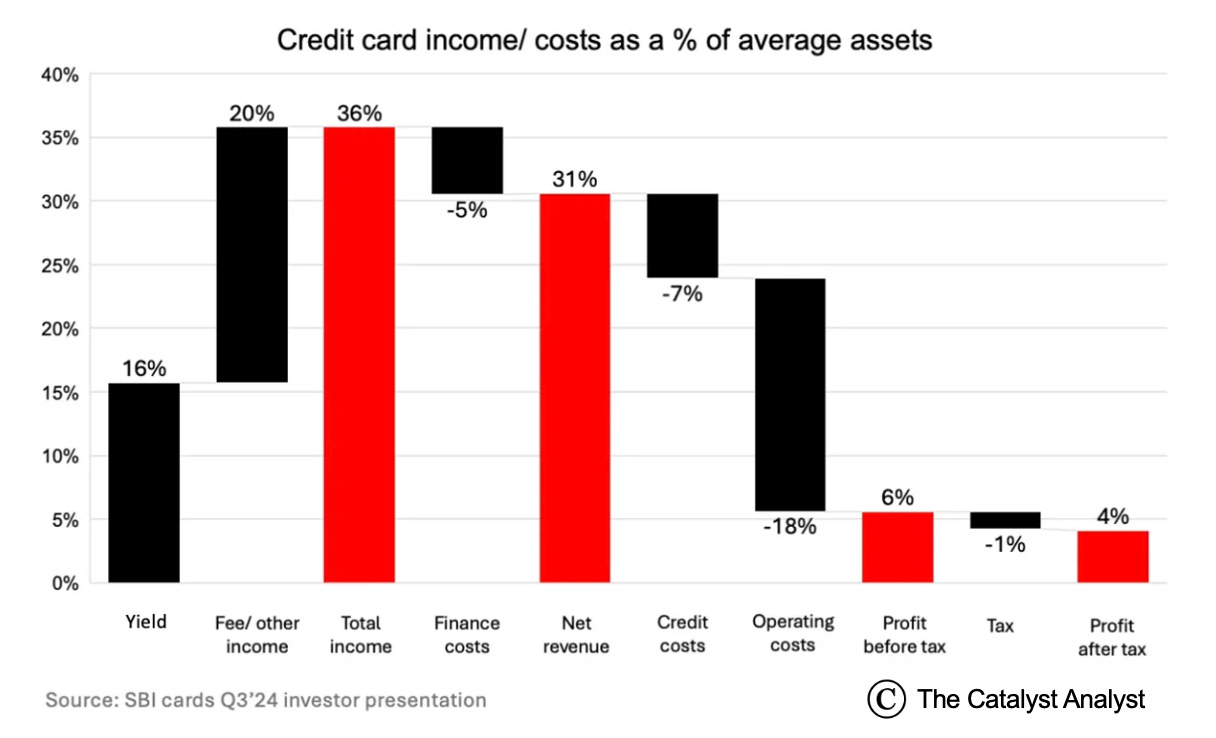

Overall, they make a lot of money from credit cards. In fact, the Return on Assets (RoA) for credit cards is ~4% vs ~2% for the overall portfolio of banks.

Since it is a very lucrative product, 34 banks offer credit cards today and because everyone is targeting the same limited set of eligible people, banks do multiple things to acquire the users:

Expensive acquisition channels: They set up stalls at high end locations like malls and airport which attract SEC-A audience and try to sell cards to them

Rewards: They offer high reward rates. Axis Magnus and HDFC Infinia, at a point, were offering reward rates as high as 31% and 33% respectively.

Offers: They run campaigns with merchants like what HDFC bank does with Swiggy

Lounge/ Golf access: They offer free access to lounges and golf lessons

Even these are insufficient in creating a tangible product difference. Hence, banks also partner with merchants to launch co-branded cards and this is where SBI cards missed the bus or let me say, caught the wrong bus.

First whammy: Decreasing market share

The most important part while launching a co-branded card is choosing the right merchant — higher a merchant’s captive base, higher is the potential number of cards issued. Further, higher the frequency of transactions on the merchant, higher is the probability of habit formation and the card being used for transactions outside the merchant platform.

“For every transaction that happens on Amazon, we are able to drive 3 or 4 transactions off Amazon. So, we have tried to become the customers' preferred card”

- Mayank Jain, Director of consumer credit and business lending at Amazon Pay

This is the reason why banks choose to partner with shopping and travel merchants wherein user base as well as transaction frequency is high. And this is where SBI faltered.

Just look at the partners of SBI vs other banks and you realise why SBI is leading from the back in the co-branded race:

Shopping: While other banks have partnered with online-first players who are leaders in their respective industries — Amazon, Flipkart, Myntra, Swiggy, Tata Neu — SBI has partnered with offline-first players. Reliance and Tata partnerships are with conglomerates but the reward structure has been defined such that it majorly rewards offline purchases.

Travel: Same story repeats here. While HDFC and Kotak have Indigo as the partner, which has 63%+ share in aviation market in India, SBI has partnered with relatively smaller airlines. On the aggregator side, while ICICI has a card with the largest aggregator - MakeMyTrip - SBI has partnered with Yatra which has 1/10th the market share of MakeMyTrip.

Fuel and Others: While SBI has decent partnerships here, these categories do not matter much because the frequency of transactions on these merchants is much lower and so is the transaction size

Result? While all major banks have at least one big winner in co-branded space— 4.7 Mn+ ICICI Amazon pay cards, 4.1 Mn+ Axis Flipkart cards and 1 Mn+ HDFC Tata Neu cards — SBI has none.

And this has multiple consequences.

One, Indian market is moving towards co-branded cards. Earlier, 1 in 10 new issued cards was co-branded, now it is 1 in 3. Thus, SBI is losing market share in number of cards issued.

Two, the activation rate and average spends on co-branded cards is much higher than other cards and hence SBI is losing spends market share year on year to other players.

Second whammy: Reduced revenue per user

Decreasing market share looks like a big concern but a bigger problem for SBI cards is reduced revenue per user.

See, credit card users can be classified into three categories:

Transactors: Who use their cards for spending but prefer to clear their entire bills by the due date

Revolvers: Who tend to not clear their dues in one go and pay interest on their outstanding

EMI takers: Who convert revolving credit into EMIs to reduce the interest burden

Companies love the latter two because they contribute to the interest income — revolver loans are given at 36-42% interest rates and EMIs at 14-18% interest rates. The interest income used to be 50%+ of the company’s income pre-pandemic but there was a major shift in user behavior post pandemic due to which this has now come down to 45%.

Influencers made users aware about high credit card interest rate while at the same time apps like Cred started sending reminders for timely payments and offering cheap and easy personal loans if the user is overdue. This led to a reduction in revolver base from 38% to 24% and increase in transactor base from 32% to 39%.

More people are taking EMIs but the rate of EMI is much lower. As a result, the yield of credit card companies has come down which has directly impacted the revenue.

Third whammy: Increased costs

If this was not enough a blow, costs have increased too for credit card companies:

Cost of capital has increased post RBI’s new directions

Per its notification in November 2023, the risk weight on credit card receivables has been increased by 25%.

The increase in risk weightage by the RBI means that credit card companies now set aside more capital. Earlier, for every Rs 100 in credit card receivables, the risk weight was 125%—that is, Rs 125. After the increase to 150%, the risk weight becomes 150% of Rs 100—that is, Rs 150. Hence, assuming a capital adequacy ratio (CAR) of 9%, the bank now sets aside Rs 13.50, at 9% of Rs 150, compared with Rs 11.25, at 9% of Rs 125. Consequently, the increase in capital requirement for lenders and card providers comes to Rs 2.25 for every Rs 100 in credit card receivables.

This means that banks and credit card providers now have to put aside more funds, reducing the amount they can lend.

Operating expenditure is increasing:

Higher customer acquisition costs because most eligible population already has a credit card; also competition has increased considerably

More costs per transaction because high rewards have to be offered and multiple merchant offers have to be run to create habits

Use of ancillaries like lounges is increasing which leads to higher costs: Cost of lounge access has increased from 0.1% of the total product cost to 0.25%

Defaults have increased because banks are attempting to increase credit card net and hence experimenting with new user personas

This triple whammy of increased co-branded cards, increasing costs and reducing revenue per user have led to the stock underperform for a long period.

There are certain ways for SBI cards to jump back for e.g.:

Launching new co-branded cards with more relevant merchants

A card with Reliance focused on its digital assets

Being the second partner for Amazon/ Flipkart who have high concentration risks today and hence are looking for more banking partners

Increasing the base of customers opting for EMIs through newer offers and better-targeted communication

EMI promotions in terms of cashback campaigns and No Cost EMI with brands across categories like consumer durables, mobile, apparel, travel & home décor

Educating customers about the ease of availing EMI options while making bigger purchases

However, SBI Cards would have to consciously work towards them else they will continue to lose market share.

And the stock will continue to underperform.

In case you liked the article, do share with those who might be interested and do consider subscribing :)

Good article. Couple of points from my end:

1| Revolver rate has come down as many startups have started offering facilities for card customers to transfer money from their card to their landlord for paying house rent. While some customers are using this facility to earn more rewards, there are also many customers who are taking this money into their own account and spending it on shopping or maybe doing option/stock trading (which can be correlated) and then rotating this money.

2| Also, there is not a strong portfolio team for credit cards in most banks. Just reporting hygiene numbers will not suddenly improve your portfolio, but doing periodic checks, analyzing movements across cohorts, using predictive analysis etc. can be useful for foreseeing any good/bad events. Credit card is engagement products and hence periodic monitoring & nudging is needed to get the most out of the customer.

3| Credit card customers are typically salaried individuals which are mostly dominated by the top 4 private banks. I don't think SBI is acquiring many private companies for issuing their salary accounts (Not very sure on this point) hence the cards get issued to self-employed individuals those with low salaries, near to retirement etc and as a result the transaction frequency might take a hit.