In 2016, RBI introduced UPI. The service fees to be charged to merchants for every transaction was fixed at 0.25% for transactions <2000 and 0.65% for transactions> 2000.

The intended first order effect was digitisation of payments. The second order effect was happiness. Banks were happy because UPI would lead to less costs (less branch visits and less share passed on the card networks), users were happy because it was very convenient and merchants were happy because the fees was lower than debit as well as credit cards wherein they were charged upto 3.5%.

What happened in years after that has changed the Indian payments landscape. The timeline of events:

2018: Government decided to subsidise the fees i.e. no fees to be charged to merchants and would instead be paid by government to the banks

2019: The fees was reduced to 0.3% for all transactions and certain type of payments were exempted from that fees

2020: MDR was removed for all UPI transactions

Since then, UPI has grown leaps and bounds. From monthly transactions worth INR 2 Trillion in Jan’20, we are at INR 18 Trillion in Feb’24 i.e. a 9x jump in 4 years.

While these initiatives did lead to the intended first order effect of digitisation of payments, the second order effects have actually been negative and are leading to problems today.

Lets dive deeper.

Deadline needs to be extended, again

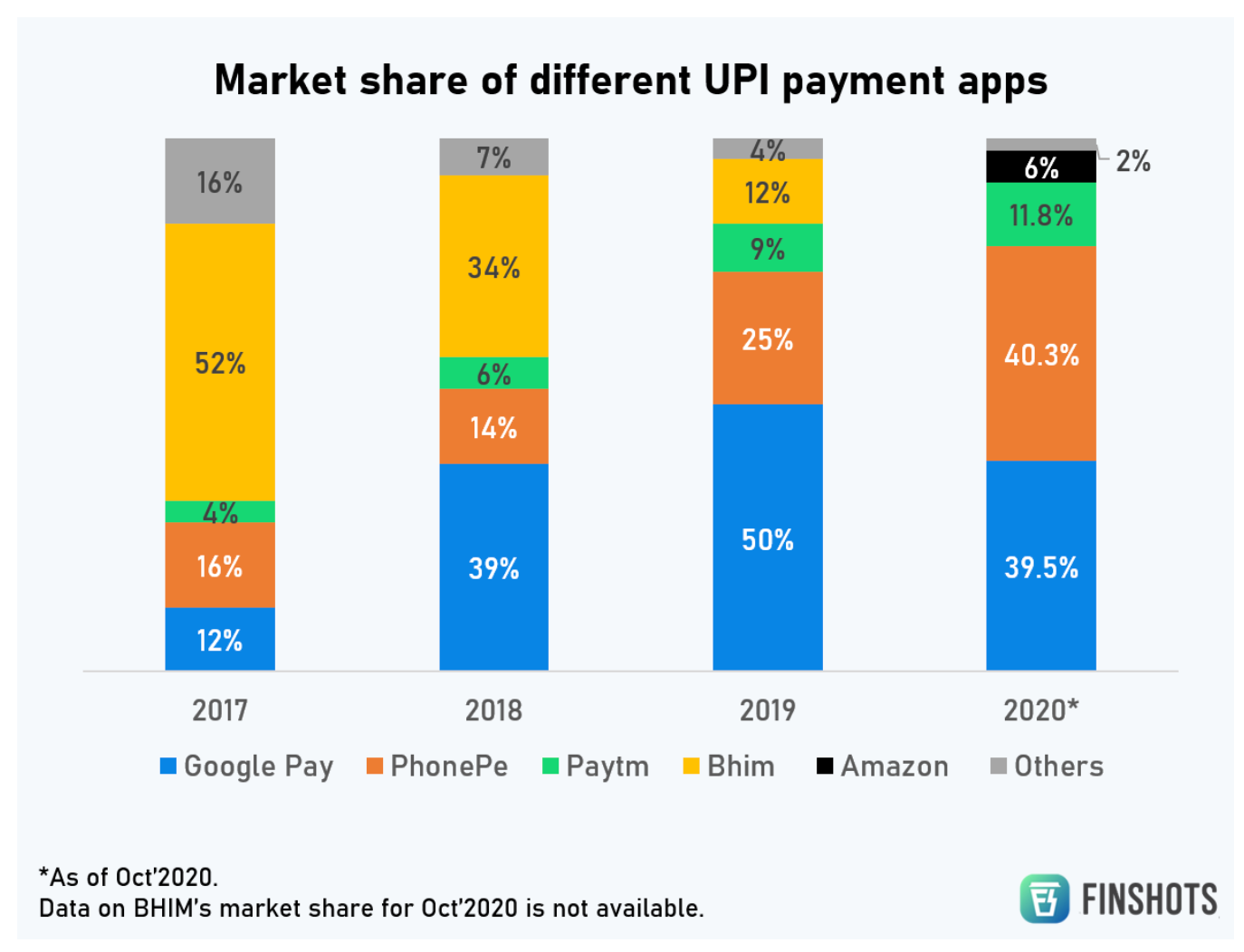

In 2020, NPCI realised that concentration risk was increasing in UPI — Google Pay and PhonePe, entities owned by Google and Walmart respectively, had 80% market share in UPI payments.

To solve this, NPCI came out with the circular limiting the market share of any UPI provider to 30% to be achieved by 2022 end.

Coincidentally, on the same day Whatsapp was given approval to offer UPI services on its app. It was expected that it would be the biggest challenge to Google Pay and PhonePe and it would likely help NPCI meet its target. And there were solid reasons for expecting that: Whatsapp at that point had 400 Mn users in India while UPI had 140 Mn. Effectively, everyone who used Whatsapp, also used UPI.

3.5 years later, this is the state today:

NPCI has extended the deadline by 2 years, to be met by 2024 end

The concentration risk has only increased. PhonePe and GPay together account for 85% market share in Feb’24

Whatsapp UPI has 0.12% market share

But why did it happen? How was Whatsapp not able to capture share?

To answer this, lets understand how any payments company makes money: In general, whenever you do a digital transaction, the merchant does not receive back full money. A small part of that amount is deducted as service charge (called Merchant Discount Rate or MDR) and is shared among all participants who helped complete the transaction—

Issuer: Bank that issued the card/ provided the account to do the payment e.g. SBI, HDFC etc.

Third party app provider/ Co-branding partner: Bank’s partner which was responsible for customer acquisition/ providing platform e.g. PhonePe, Jupiter, Cred etc. (If bank does transaction itself then this is not applicable)

Acquirer: Bank that opened the merchant account e.g. SBI, HDFC etc.

Network: E.g. Visa, Mastercard, NPCI etc.

These charges are taken by the participants because they incur costs for processing the transactions.

In case of UPI, the MDR is zero but the costs are still there. Infact, as per RBI, the costs to do a INR 800 transaction on UPI is as high as 0.25% off which:

Issuer incurs charge of 0.1% of transaction value

UPI app provider incurs 0.06%

Acquirer incurs 0.07%

NPCI incurs 0.02%

This means that all participants incur costs but the earnings are Nil.

To support the industry, government in 2022 introduced incentive scheme wherein incentives are given for UPI transactions worth less than INR 2000 and on Rupay debit card transactions. However, there are 2 problems with the scheme:

Budget allocation to the scheme has reduced year on year:

2022-23: 2600 Cr

2023-24: 2485 Cr

2024-25: 1441 CrAnd this is when the value of UPI + Rupay debit transactions has swelled year on year:

2022-23: 140 Trillion UPI + 24 Trillion Rupay

2023-24 (till Feb): 140 Trillion UPI + 22 Trillion RupayThe incentives are given only on UPI transactions worth less than INR 2000 and on Rupay debit card transactions, but the costs are incurred on every transaction

Just look at the chart below which shows how effective MDR has changed year on year.

With the cost of processing a UPI transaction for the ecosystem being ~0.25% of the transaction value, ecosystem loses money on every transaction.

Add to this the fact that whenever a new player would try to gain share, they would have to contest the duopoly of Google and PhonePe and there is only one way to do that, continuous investment. You spend large amounts to make people aware about the existence of the feature in your app (e.g. Leander pays using Cred UPI) and then you spend further to change consumer habits (e.g. cash backs given by Cred, Jupiter etc.).

Thus, only those companies grow and sustain in UPI arena, that can burn money for long and are willing to do that, and Whatsapp was on the other side of the table. Quoting Moneycontrol:

What mattered most was WhatsApp's unwillingness to entice customers with cashbacks.…….“India is not a free market. You need to invest in payment discoverability on the app. Then you need to make people aware that WhatsApp now has payments. Finally, you need to incentivise them with cashbacks to change an existing payment behaviour. And they (Meta HQ leadership) were ambivalent or unhelpful on all of these counts and failed the India team,"

According to a couple of sources aware of the matter, the India team had requested the Meta HQ for a marketing budget to the tune of $50 million, including for cashbacks and promotional activities (for Whatsapp UPI). In 2021, the Meta global team did allocate $50 million for the India team, but they spearheaded the marketing expenditure around other issues instead of payments.

The common argument for Zero MDR is that small merchants would not continue using UPI and move back to cash but evidence (albeit in a different geography) says otherwise.

Lessons from Pix: MDR is not a deterrent

Brazil’s retail payments were 70% cash in 2020, but things have changed considerably now. In 2020, four years after UPI, Brazil’s central bank launched Pix: A real time payment system just like UPI. Aim was the same as UPI: Increase digitisation, reduce costs for all players- merchants and banks, increase convenience for the user.

Only difference being that Brazil let market forces decide the MDR. Today, the MDR on Pix merchant payments is 0.22% and still look at its growth (also see how it compares with UPI):

The slope of the two lines is almost similar — UPI is growing faster but Pix is also growing really fast. The absolute numbers are much smaller but considering the fact that Brazil’s population is 1/7th the size of India’s population and that Pix was launched 4 years after UPI, it had to be the case.

Even if we look at penetration in the population, 66% of the total population of Brazil uses Pix vs 300 Mn or 20% of the Indian population.

This is a clear evidence that including a minimal MDR would not really impact UPI transactions. Government is concerned about its adverse impacts on financial inclusion but there are creative ways of ensuring that mission of financial inclusion still progresses, like the one suggested by Pwc:

We suggest that a model be introduced that helps to recover the minimum costs and promotes investments to upgrade the banking infrastructure and enable consumer literacy and fraud prevention. For P2M transactions, we can have a slab-based model in which smaller merchants or merchant in tier 3 and 4 cities are not charged any MDR, while large merchants can be charged a minimum transaction cost. The definition of smaller and larger merchants can be similar to the one as prescribed for debit card transactions. For P2P transactions, there can be no charges for a certain number of transactions defined on a daily or monthly basis, after which a minimal charge can be levied from the payment originator.

Unless and until this or any other solution that makes UPI lucrative is implemented, a future wherein no player has more than 30% share of the UPI market cannot be imagined and NPCI would be forced to extend the deadline again.

UPI’s solution would remain UPI’s problem.

@Ramji : Great article! Are you implying that there is opportunity for new players in the market? If so, how can they take on the existing players when they already have a large market share & high penetration?