(#19) Credit line on UPI needs more policy changes to replace credit cards

With the introduction of 1.2% MDR on credit line on UPI, NPCI is hoping that the product would take off. While interest ladden credit line certainly will, an interest free credit line needs much more.

Credit line on UPI was introduced by NPCI in Sep’23. In its two form factors —interest ladden credit line and interest free credit line — the product was expected to revolutionise the way consumers used credit and increase credit penetration in the market.

Alas! it did not happen.

It has been almost an year since the product was launched and it is yet to see much adoption.

Last week Moneycontrol reported that NPCI is planning to sweeten the deal for stakeholders by introducing 1.2% MDR on the offering and is expecting that it would drive the take off of the product.

I strongly feel it would certainly drive adoption for the interest ladden credit line on UPI offering because the product solves a real pain point for the banks- ability to track and control the end use of money. Today, user can transfer credit line amount to his account and use the money for anything— from paying money to a merchant to sending it to a friend to paying another loan. With a credit line on UPI, not only can the money be used only for merchants payments but also the end use is trackable. On top of this, 1.2% interchange becomes an additional earning for the banks thus giving them more reasons than one to push the interest ladden credit line on UPI.

However, I don’t see interest free credit line product (which emulates a credit card) getting any significant traction. Ofcourse, unless there is another policy change, one that RBI has remained shy of since long.

Lets dive deeper!

Credit card penetration has always been low in India primarily due to two reasons. One, only banks can issue credit cards and most of them are conservative in their approach: Despite credit cards being the most lucrative instrument for banks, banks are very selective in offering them. Credit cards are primarily given to:

Users with a credit score: Banks don’t use alternate data leading to no credit cards for new to credit users (unless they have a strong and long relationship with the bank)

Salaried users: 62% of SBI’s credit cards are given to salaried population. Even among salaried, banks are selective; there are 95 Mn salaried people in India but only 45 Mn credit card holders

Existing customers of the bank: ~60% SBI credit card customers are SBI users

Two, card acceptance infrastructure in India is inadequate. ~70% of shopping by Tier 2+ users happens at offline merchants who, more often than not, do not have card acceptance infrastructure (~9 Mn POS machines in India of which ~60% are in Tier 1 cities). This leads to a demand as well as supply problem. On one hand, users living in Tier 2+ cities do not feel the need to get a credit card; on the other hand, banks prefer giving cards to tier 1 users (65% of Credit card users are from Tier 1 cities) because while the costs of serving a tier 1 vs tier 2 customer are almost the same, the average monthly spend per user in tier 2 is much lower at 7-10K vs 15K+ in tier 1

In June 2022, by allowing Rupay credit cards on UPI, NPCI increased the card acceptance infrastructure overnight from 9 Mn merchants (served through POS machines) to 35 Mn+ merchants (served through QR codes) and solved the second problem completely. At the same time, third party apps (TPAP) like PhonePe and Google Pay who had lion’s share of UPI market but faced monetization problems, saw huge potential to monetize here and hence started pushing users to add their Rupay credit cards to UPI.

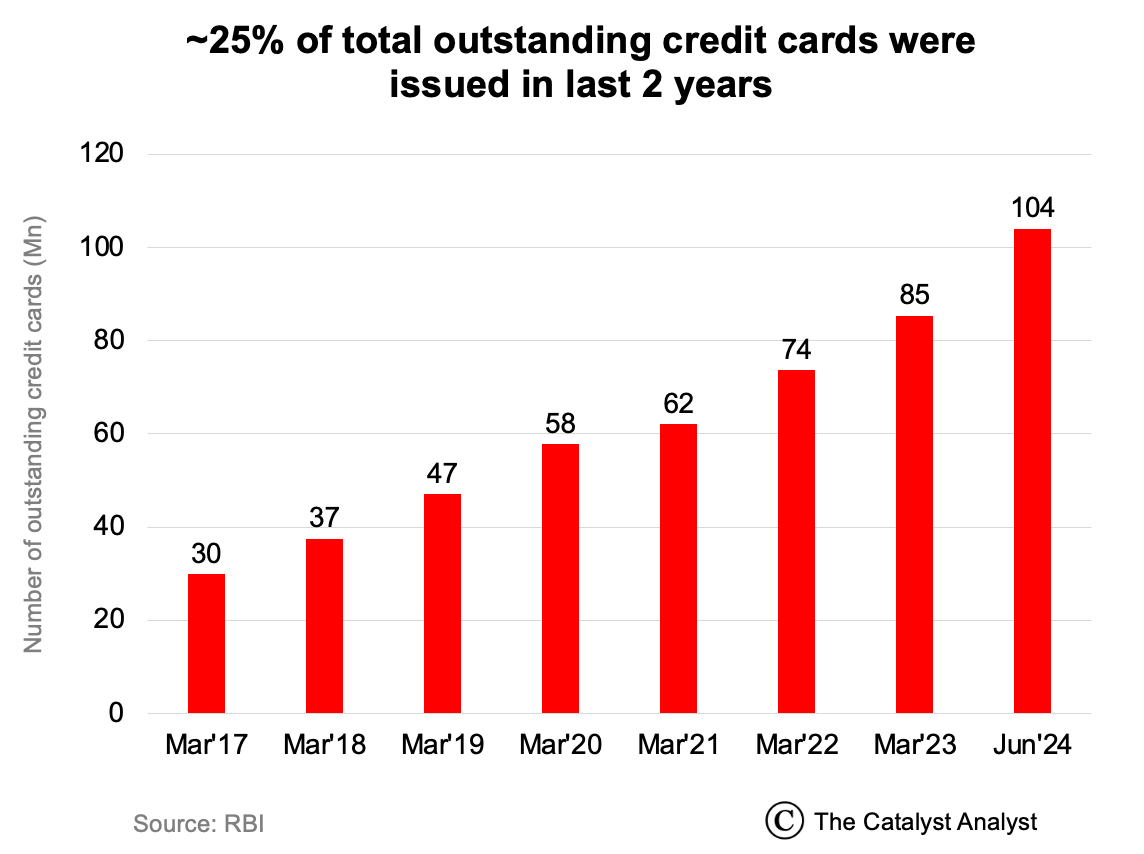

Result? Explosive growth in credit cards- from 78 Mn in Jun’22 to 104 Mn in Jun’24.

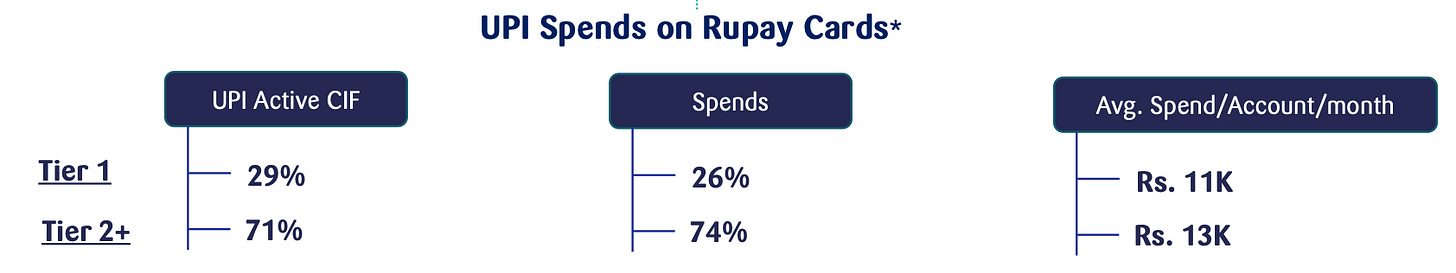

More importantly, 30% of the new credit cards issued in the country are on Rupay network vs 5% earlier, primarily driven by user demand. Unsurprisingly, most of this demand came from tier 2+ cities. As seen in the results of SBI cards below, 71% of active Rupay on UPI customers and 74% spends are from tier 2 cities. Even the average spend per account per month on Rupay UPI cards is higher for tier 2 cities at 13K vs 11K for tier 1 users.

However, existing credit card users have accounted for most of this growth and hence the number of unique credit card holders has not increased very significantly and stands at ~40-45 Mn users today. This happened because most banks have not made any significant change in their policy for card issuance and have continued to give cards primarily to salaried and prime customers.

When credit line on UPI was launched in Sep’23, I expected things to change because even NBFCs are allowed to offer credit line products is India. However, by allowing only scheduled commercial banks to issue the offering, RBI maintained the status quo. The product was inferior to credit cards from issuer’s as well as customer’s point of view:

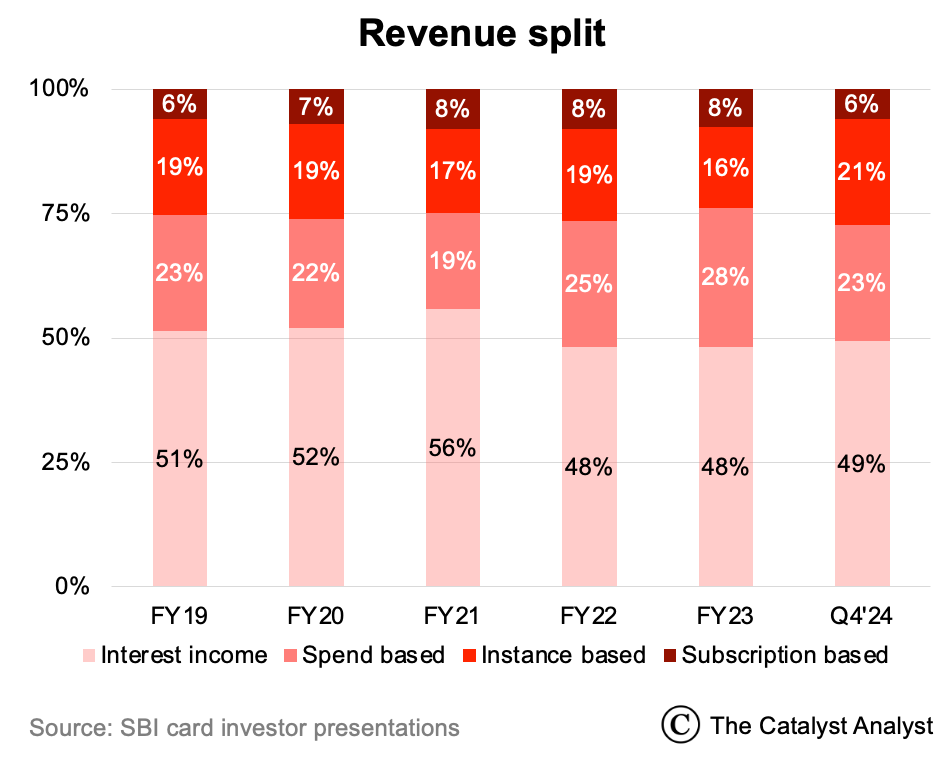

Issuer: As I said in The triple whammy for SBI cards, credit cards offer multiple revenue streams to the issuer:

Banks make money from multiple streams. They charge a joining and annual fee for the credit card. They earn interchange income when you transact. They earn fees whenever you do late payments/ do foreign transactions/ take cash advances etc. Most importantly, they charge you interest every time you pay late or if you pay only the minimum due.

Overall, they make a lot of money from credit cards. In fact, the Return on Assets (RoA) for credit cards is ~4% vs ~2% for the overall portfolio of banks.

Credit line on UPI offered all income streams except the interchange income which is usually ~25% of a credit card company’s income, thus giving no incentive to banks to push this product over credit cards.

For the TPAPs, Rupay credit cards on UPI were solving the monetization problem by getting them a share of the MDR. In absence of MDR, there was no scope for TPAPs to make money from credit line on UPI and hence they never pushed it forward.

Customer: Credit cards are exciting to the user for two reasons: one, they offer free credit period and two, they offer rewards. While banks could potentially offer a free credit period but in absence of the interchange income, banks did not offer rewards making it an inferior proposition for the user.

As a result, the product never saw much take up.

NPCI has realised this now and hence has proposed to introduce 1.2% MDR on Credit on UPI transactions which would bring the offering almost at par with credit cards. I do expect to see some take up now but most of it would come from cannibalization of the opportunity that Rupay cards on UPI have.

The only way to unlock the next level of growth is to solve the supply problem — either by making banks less risk averse (which is unlikely) or by allowing NBFCs and SFBs to issue the product.

The real reason why RBI has been reluctant to let NBFCs issue credit cards till now has been their inability to monitor ~9500 NBFCs which exist in India who may not be subject to as frequent and detailed scrutiny as banks, potentially leading to systemic risks. Considering that Credit line on UPI does not really solve for that, it is unlikely that anything would change there.